Stock Market Volatility: Acting vs. Reacting

Submitted by JMB Financial Managers on January 25th, 2019

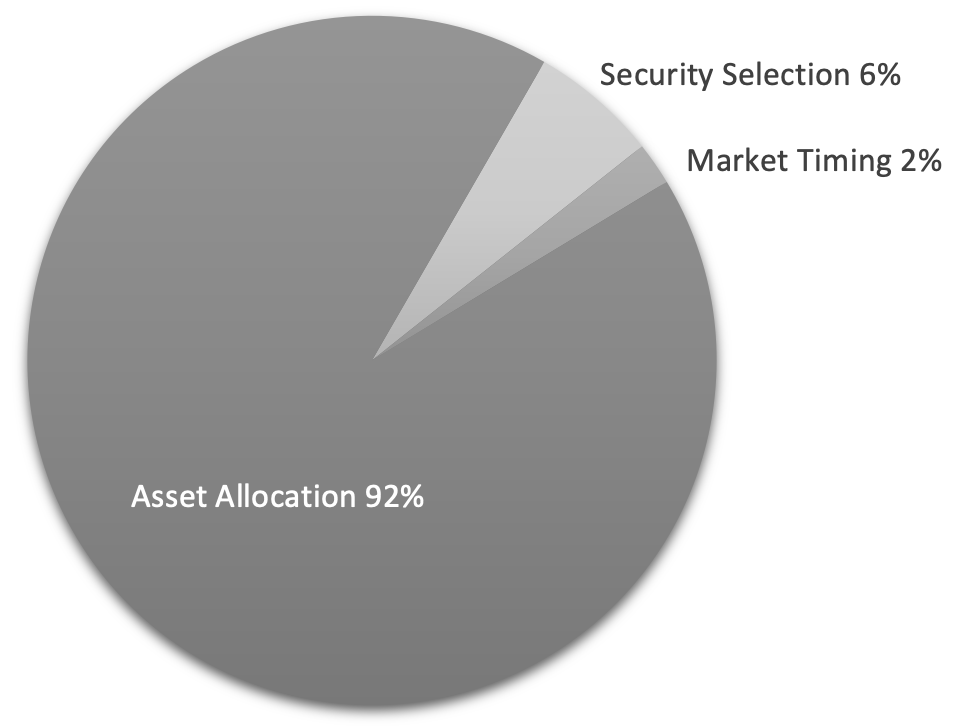

The volatile market is in the news, in the headlines, and more than likely, in your portfolio. Erratic stock markets can be worrisome for everyone - but it does not have to be. When it comes to investing, I always like to remind my clients that the best approach when the equity market is fluctuating wildly is to implement a predetermined plan of action, rather than making emotional, split-second investment decisions in the heat of the moment.

Price Swings are Inevitable

As you likely already know, the stock market will come down in value at some point in time. Whether caused by changes in the economy, higher income taxes, interest rate changes by the Federal Reserve, unexpected moves in a foreign currency, international trade tensions, or a presidential election, declines in the financial markets are inevitable.

Sometimes these declines will be a long drawn out bear market that lasts several years, and other times it will be a big drop in a very short period of time. Knowing this to be the case, it is important to be prepared ahead of time. This involves understanding risk, and having a plan to manage it.

Understanding Risk

For investors early in the saving phase of life, procrastination is the primary source of risk. For investors who have been at it for a while, an insufficient savings plan is the primary source of risk. For investors that are closing in on their goal – those within 1 to 5 years of retirement, for example – large market swings that lead to big losses in your portfolio are the most important source of risk. For investors already drawing upon their investments, longevity is the largest risk.

Finally, taking insufficient risk can derail you from reaching your personal investment objectives before you even get started, no matter how much you save. Take a moment to click below for an evaluation of your risk tolerance.

Ultimately, you can see that the definition of risk, and the source of it, changes over time as you move through the various stages of life.

The Need for Active Risk Management

In Your Twenties

If you are in the early stages of your career, you may not have a large amount of money to save, but you do have the most powerful asset of all on your side – time. If you are in your mid-twenties for example, your investments will have forty years to compound, no matter how modestly you begin. The risk is that you decide to procrastinate from investing for the future, turning time into your enemy.

In Your Thirties and Forties

If you have reached your mid-thirties to mid-forties, you have already given away a large chunk of the time available for your investments to compound. While time is not yet your enemy, not having a savings program in place that is sufficient to reach your desired result is your biggest risk.

When Preparing for Retirement

As your career winds down and you are looking at retiring in the next five years or less, stock market volatility can postpone your intended retirement date and force you to remain in the workplace much longer than you desire. For example, it took the Dow Jones Industrial Average until mid-2014 to recover from the 2007-2009 great financial crisis recession. The risk you face is one of not having a plan to moderate the effect of out-sized investment losses during this crucial period.

During Retirement

If you have already retired, longevity risk – the risk of out outliving your resources – is the primary risk you face. The failure to have an investment plant that moderates market risk can have a devastating effect on your quality of life if you reach old age with a declining asset base.

Risk Management for Every Season of Life

Regardless of where you are in the seasons of life, loss aversion – taking insufficient risk with your investments – can undermine long-term effect of compounding, a good savings program, and adequate assets to commit to your goals.

Educating yourself about these risks and actively managing them – or working with an investment advisor versed in doing it - can be the difference between succeeding in your long-term goals and failing to achieve them.

What is Active Risk Management?

Risk management is a three-pronged process to:

- Identify the most important risks you face at each stage of life.

- Assure that you are taking sufficient risk to meet your goals.

- Limit your losses during the inevitable price swings in stocks.

Active risk management takes it a step further by repeating these steps on a regular and consistent basis over time.

Identifying the most important risks you face at each stage in life is a qualitative exercise to be completed at various stages in life, such as when you change jobs, your marital status changes, and at milestone birthdays (i.e. 25, 50, 35, and so on).

Assuring that you are taking sufficient risk to meet your goals is a quantitative exercise taken every three to five years, and includes making forward projections for reaching your goals and historical analysis of the returns achieved in the past.

Limiting your losses during bear markets and periods of sudden, high volatility requires an investment strategy that adjusts your portfolio risk as the economy, markets, and your needs change through time. Such a strategy uses tactical asset allocation to make changes in your portfolio to limit your investment portfolio losses when necessary, while staying out of the way and letting the portfolio grow when market conditions permit.

What is Tactical Asset Allocation?

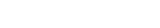

Asset allocation creates a diversified portfolio by dividing your portfolio among different investment types, most commonly among cash, bonds, stocks, commodities, and real estate. Choosing your asset allocation is the most important concept in portfolio success.

Asset allocation creates a diversified portfolio by dividing your portfolio among different investment types, most commonly among cash, bonds, stocks, commodities, and real estate. Choosing your asset allocation is the most important concept in portfolio success.

Studies have shown that selecting the asset allocation of a portfolio is far more important than selecting which investment to buy. In fact, almost 90% of investment returns come from asset allocation and less than 6% comes from security selection. Stated more simply, it pays to have your money in the right place at the right time.

Tactical asset allocation is an active risk management strategy that allows a flexible division of your portfolio among investment types that adjusts to favorable and unfavorable market conditions.  For example, the U.S. economy follows a cycle of recession, recovery, expansion, and contraction, before returning to a recession once again.

For example, the U.S. economy follows a cycle of recession, recovery, expansion, and contraction, before returning to a recession once again.

Tactical asset allocation allows you to allocate more of the investment portfolio to stocks and real estate during the recovery and expansion phases of the economy (thereby maximizing your opportunity for gain) and to allocate less of the portfolio to theses investment types during contraction and recession (thereby limiting your opportunity for loss.)

One of the main advantages of tactical asset allocation is that changes in your portfolio come from pre-established rules and benchmarks based on factors such as the economic cycle, rather than emotions, which can cloud your judgement.

You Can Benefit from Active Risk Management

Market volatility is a complicated concept that can be difficult for even the most seasoned investors to grasp. For this reason, it can be highly beneficial to trust your investment decisions to a firm like us that uses active risk management with a reputation for success.

To obtain a risk analysis click here.

To learn more about tactical asset allocation, download our free brochure.

To schedule an introductory consultation use our calendar.

--

About the Author

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Connect with Jack on LinkedIn or follow him on Twitter.

Disclosure:

The views stated in this letter are not necessarily the opinion of Cetera Advisors LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change with notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. Investors should consider their financial ability to continue to purchase through periods of low price levels. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be profitable. Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing. Exchange traded funds (ETFs) and mutual funds are sold only by prospectus. Investing in ETFs and mutual funds is subject to risk and potential loss of principal. ETFs incur trading and commission costs similar to stocks and frequent trading can negate the lower cost structure of an ETF. There is no assurance or certainty that any investment or strategy will be successful in meeting its objectives. Investors should consider the investment objectives, risks and charges, and expenses of the fund carefully before investing. The prospectus contains this and other important information about the fund. Contact your registered representative of the issuing company to obtain a prospectus, which should be read carefully before investing or sending money.

JMB Financial Managers Mid-Year Review for 2025

Click the button below to download a pdf of insights and predictions for the rest of the year.