Comprehensive Financial Planning: What is it Anyway?

Submitted by JMB Financial Managers on October 8th, 2018

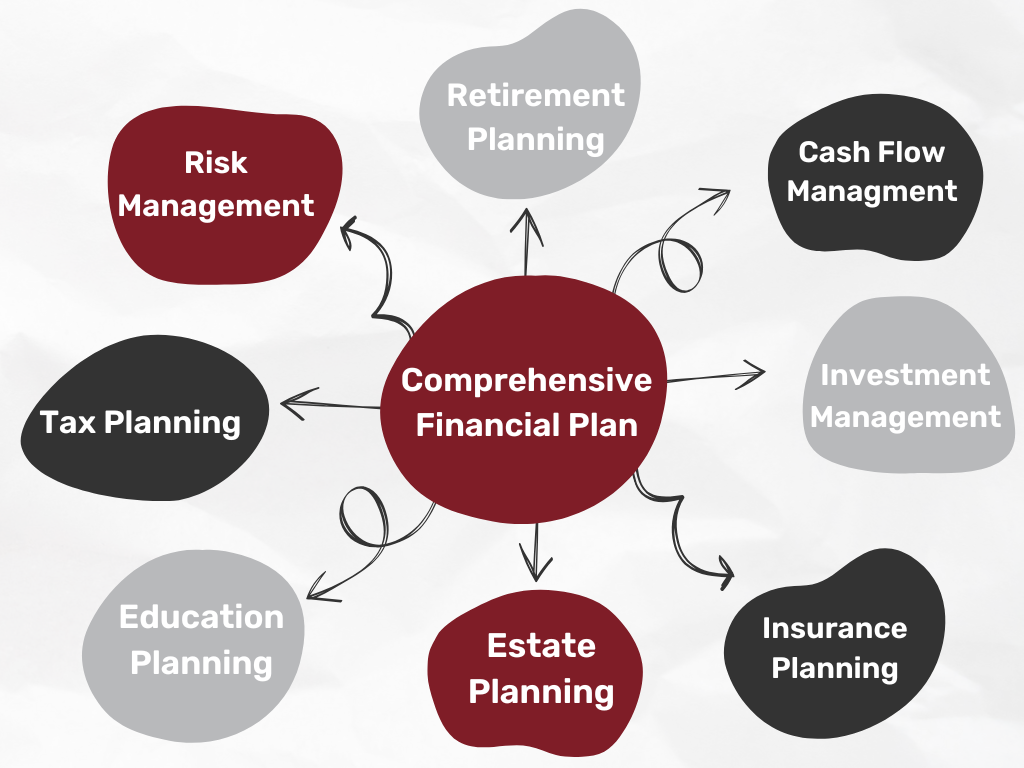

When it comes time to create a roadmap for your financial future, you hear the term “comprehensive financial planning” thrown around often, whether it’s during your research of reliable sources or in talking with a Certified Financial Planner®. You'll see and hear terms like cash flow analysis, credit score, emergency fund, net worth statement, your child's education, employee benefits, review of insurance policies, retirement planning, social security benefits, and estate planning. It is also possible that you'll look at that list and become overwhelmed because it can seem pretty ambiguous, but in reality, it can be broken down into understandable terms.

So, with that said, what is comprehensive financial planning anyway?

It is a Process Rather Than a Product

Most people understand that accumulating wealth and achieving long-term goals don’t happen overnight. This understanding is the basic principle of how comprehensive financial planning works. It is about walking through a process that helps you move closer and closer to achieving your goals over time. It incorporates all aspects of personal finance into a roadmap that is unique to your life, flexible enough to adjust over time, and comprehensive enough to cover each aspect of your financial life that you want to include.

Most people understand that accumulating wealth and achieving long-term goals don’t happen overnight. This understanding is the basic principle of how comprehensive financial planning works. It is about walking through a process that helps you move closer and closer to achieving your goals over time. It incorporates all aspects of personal finance into a roadmap that is unique to your life, flexible enough to adjust over time, and comprehensive enough to cover each aspect of your financial life that you want to include.

The financial planning process is a valuation of your current financial condition, a summary of the things you want to accomplish, and a set of directions to help you get from the present to the financial future you want. It will address current savings, budgeting, insurance, investments, taxes, estate planning, retirement, and charitable giving.

One thing the financial planning process is not is buying an investment or insurance product. It isn't about opening savings accounts or a retirement account either. Although there is a multitude of financial products that you can use to help accomplish your goals, simply investing and hoping for the best is not the key to having the peace of mind and enjoyment of life that you’re looking for. Financial products cannot adjust to changes in your circumstances, priorities, or concerns, whereas a comprehensive financial plan can be altered to incorporate whatever life throws your way.

A Flexible, Ongoing Process Built Around You

Everyone has different goals, so it’s important to have a unique plan that works for you and your current financial situation, both now and in the future. Financial planning takes the guesswork out of managing your finances and helps you understand the implications of each financial decision. It also helps you understand things about your financial decisions and how they interconnect, such as how a decision about paying for your child's education could impact your retirement.

A comprehensive plan is deemed “comprehensive” because it is about more than just money; it is built around your specific goals, your core values, and what matters most to you in life. It is personal and in-depth. It takes into account all of these factors and addresses your finances in a way that will help you reach your goals in a way that aligns with your values. It not only defines how wealth accumulation can help you but others in your life as well.

Financial planning is a dynamic process. Your financial goals may evolve over the years due to shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, purchase of a home or other real estate, or building a family. As you begin to consider how best to manage your financial future, you should feel confident knowing that with a CFP® professional, you’re working with someone committed to providing the highest standard of financial planning and making sure you’re set up for financial success.

Necessary and Preventative Planning

Comprehensive financial planning is crucial if your goal is to accumulate and preserve your financial resources for years to come. It takes into consideration the best ways to minimize tax burdens and debt, in addition to adjusting your savings plan and preservation tactics as life events unfold and your risk tolerance changes. It helps you play defense as well as offense and reduces the odds of you making financially destructive decisions.

Your plan, as well as the qualified financial planner who assisted in its making, should act as your compass and help you through the rough patches. Because these types of plans are so highly personalized, they should help you build and retain lifelong wealth, maximizing your financial well-being.

Some people decide to perform their financial planning themselves, but you may want to seek help from a CFP® professional if you:

- Don’t have time or level of skill to perform your financial planning or maintain a proactive approach to it

- Want to monitor and adjust your plan on an ongoing basis so you stay on the right track

- Want a second, professional opinion about the plan you’ve developed on your own

- Want to better manage your finances but aren’t sure where to start

- Don’t have expertise in certain areas such as investing, insurance, or taxes

- Don't know how to be financially and emotionally ready for a retirement lifestyle

- Aren't sure how to be ready for the cost of a college education for family members

- Have an immediate financial issue or unexpected life event and don't know where to turn

The benefits of comprehensive financial planning are abundant. Get started on your comprehensive financial plan today!

Let's Discuss Your Financial Planning Needs

--

About the Author

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Jack Brkich III, is the president and founder of JMB Financial Managers. A Certified Financial Planner, Jack is a trusted advisor and resource for business owners, individuals, and families. His advice about wealth creation and preservation techniques have appeared in publications including The Los Angeles Times, NASDAQ, Investopedia, and The Wall Street Journal. To learn more visit https://www.jmbfinmgrs.com/.

Connect with Jack on LinkedIn or follow him on Twitter.

JMB Financial Managers Mid-Year Review for 2025

Click the button below to download a pdf of insights and predictions for the rest of the year.