Current Events

Inflation is Coming - 4 Reasons Why, and How to Prepare

Submitted by JMB Financial Managers on November 17th, 2020The CARES Act and Required Minimum Distributions

Submitted by JMB Financial Managers on November 6th, 2020

In hopes of stimulating the economy during the COVID-19 pandemic, the federal government passed the CARES Act, that not only provided aid to those in need but included changes to your retirement plan. As we near the end of 2020, we wanted to provide you with the latest information on how the CARES Act impacts you, your retirement, and your taxes.

Mark Your Calendar for These 2020 Financial Deadlines

Submitted by JMB Financial Managers on June 30th, 2020

It’s normally easy to keep track of your numerous financial deadlines, but this year got off to a rocky start, and consequently some financial deadlines were pushed back by the Federal Government. I suggest reviewing the list below and updating your calendar as needed so you don’t miss these important deadlines!

Cybersecurity Alert: Coronavirus Phishing Scams

Submitted by JMB Financial Managers on March 12th, 2020

As the Coronavirus continues to spread worldwide, so do phishing attacks disguised as helpful information on the outbreak. Security experts report an uptick in phishing messages being sent to businesses and individuals on the topic.

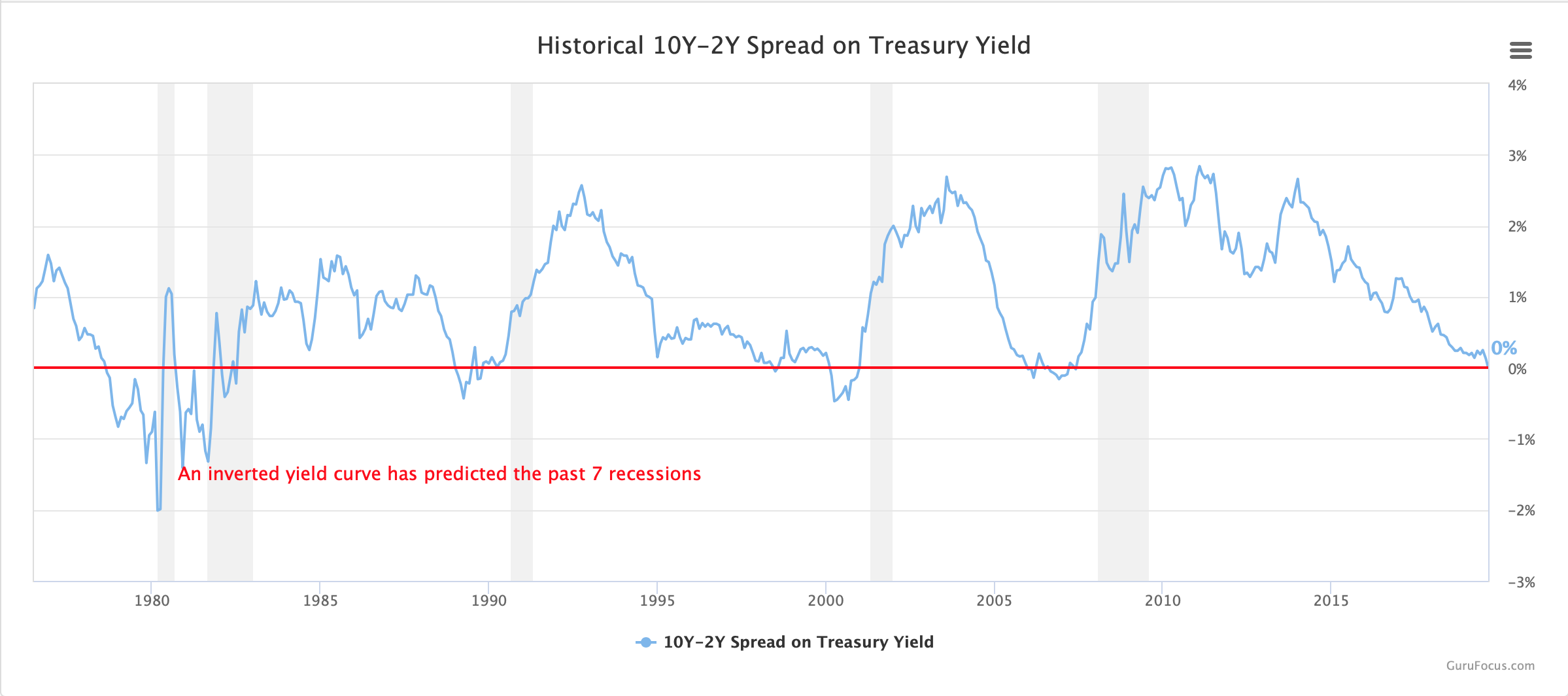

The U.S. Bond Market is Not Signaling a Recession

Submitted by JMB Financial Managers on September 12th, 2019

A Recession is Not on the Horizon for the U.S.

Global interest rates are plunging as investors brace for a worldwide slowdown. Global investors have now pushed the yield on the benchmark 10-year Treasury note down to 1.46%, with most of the drop occurring over the past three weeks. We also recently saw the U.S.

The Yield Curve Inversion: Harbinger of Doom, Early Warning Sign, or a Bunch of Hype?

Submitted by JMB Financial Managers on August 27th, 2019Corn Crop News Turns Dour

Submitted by JMB Financial Managers on August 20th, 2019

The 2019 corn crop looks set to go from bad to worse, which should boost prices of the grain at the grocery store, in addition to pushing the cost of beef, chicken, and pork higher with it.

Why is the US Bond Market on a Tear, Pushing Rates Lower?

Submitted by JMB Financial Managers on August 12th, 2019More Bad News for Your Grocery Budget

Submitted by JMB Financial Managers on August 2nd, 2019

First it was the looming shortage in U.S. corn supplies; now we have a global pork supply problem. Pork supplies are expected to drop by the largest percentage ever. The record-breaking drop in global pork production will mean a massive shortfall of meat.